Spencer Glendon, Founder of Probable Futures, Carolyn Kousky, Founder of Insurance for Good, and Barney Schauble, Principal at greenthread, wrote this article in collaboration. Spencer, Carolyn, and Barney have worked at the intersection of climate change and financial risk for many years from different perspectives. This is the first in a series of essays where they will share what they’ve learned.

Property insurance is a remarkable product that developed in a climate remarkable for its stability. For centuries, risks from floods or fires or hurricanes were manageable and people could settle almost anywhere. The probability of risks was stable. For example, instead of saying that a storm had a 1% probability, we called it a “1-in-100-year storm”, implicitly assuming that all 100-year periods would be the same. This predictability made property insurance a minor concern and a minor expense. It was good to have, and sometimes a regulatory obligation, but it was hardly worth deeper consideration. Why focus attention on something that you rarely need and that doesn’t cost much?

But as natural disasters grow more frequent, extreme, and damaging, more people and businesses are struggling to afford—and even get—insurance. In places of increased climate risk from disasters such as fires and storms, insurance has gone from an afterthought to a source of concern, dismay, and anger. Forced to pay more attention to property insurance, many people—from consumers to issuers to regulators—have begun to question who needs property insurance, whether it will be affordable, and even whether our future is insurable at all. Few people understand how much of a Goldilocks product insurance has been or how profoundly both capital markets and communities rely on it. The challenges that the insurance industry faces offer a valuable lens to understanding property markets, financial markets, and the broader economy in a changing climate.

No society has ever been able to insure everything, but under the right circumstances, insurance markets can thrive. Where that has happened, insurance has quietly evolved from a niche product to being foundational to nearly all economic activity, making society able to take more risk and undertake a wide range of beneficial economic activity. Rising climate risks across the globe, however, are beginning to contract the range of what is insurable. Investments in climate adaptation and loss reduction, as well as innovation in risk transfer products and approaches, can help push against this contraction, but there are limits to insurability. What are they? How is our warming atmosphere shrinking the range of insurability? How can insurance markets adapt? How do we make communities and economies more resilient?

The limits of insurance

Insurance is a form of “risk transfer.” Property insurance allows the owner of an asset to transfer a portion of the risk that their asset is lost or impaired to another party (an insurer) that is better able to hold the risk. The asset owner is willing to pay some amount every year to be protected against a large financial loss. From the asset owner’s perspective, an insurance contract may appear to be a simple financial agreement between two parties, but insurance is fundamentally a collective endeavor.

Insurable risks must be ‘just right’: neither too big nor too small, known and not too likely, and uncorrelated with each other. Risks that meet these criteria are insurable; risks that don’t are uninsurable.

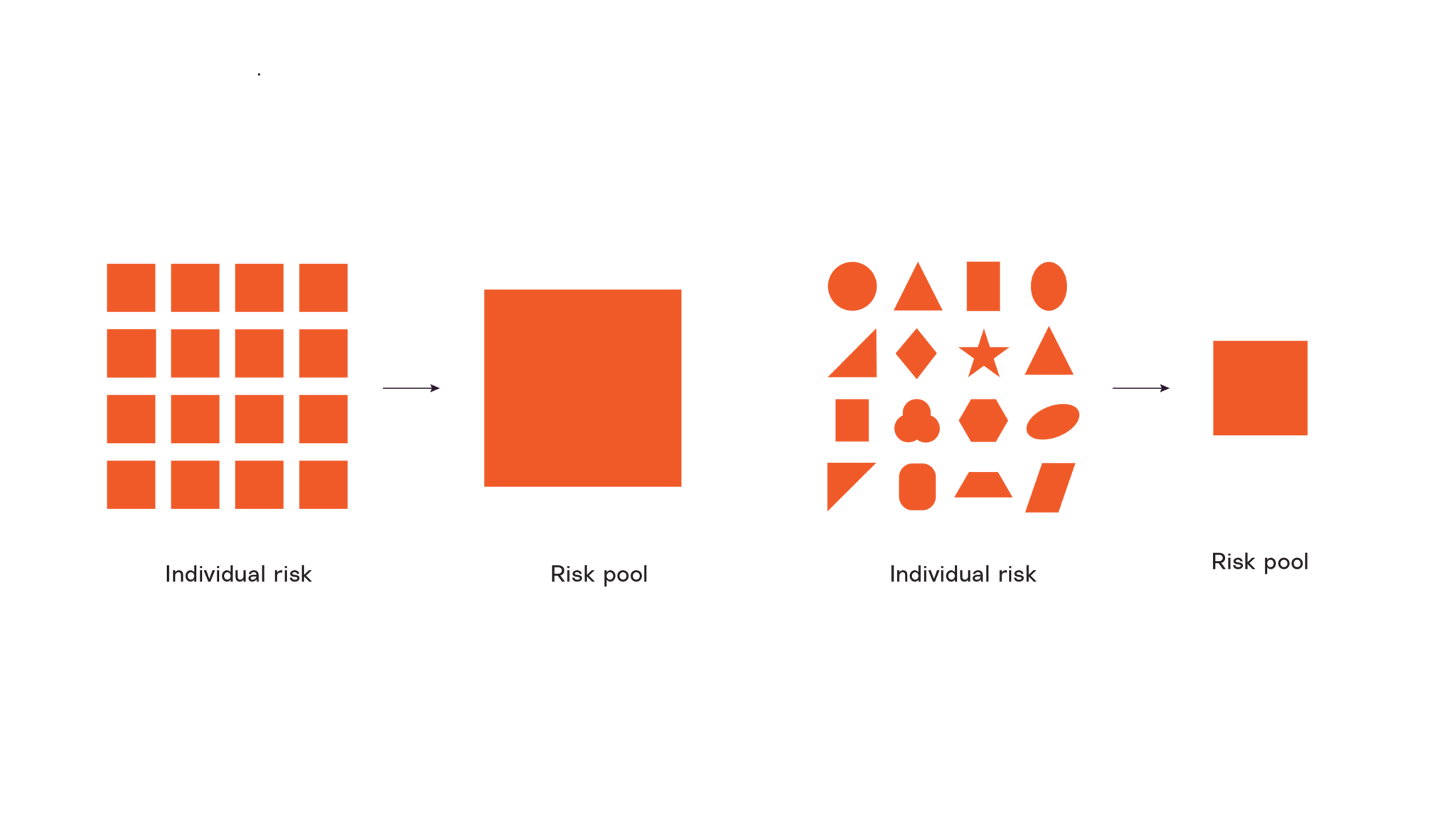

Insurers create portfolios by pooling many different risks from many different asset owners in many different locations. This pooling, when the risks meet certain conditions, is enormously powerful. It allows policyholders to access payouts for large losses at lower annual costs. When considering the cost of insuring a specific asset, an insurer considers not just the likelihood and severity of risks that the asset will face, but also how those risks and the expected losses relate to all of the other assets that are in their pool. Insurable risks must be “just right”: neither too big nor too small, known and not too likely, and uncorrelated with each other. Risks that meet these criteria are insurable; risks that don’t are uninsurable.

Risk type vs. risk pool size

Insurance pays individual asset holders in the event of a loss. If individual risks are similar and correlated, an insurer needs to be prepared to pay many claims at once, which requires a large risk pool (large amount of capital). In contrast, diverse individual risks are unlikely to be impacted at the same time, so insurers can hold a much smaller risk pool (smaller amount of capital).

As such, there are limits to the benefits of risk pooling. Technically, only independent risks that are not too severe produce benefits from risk pooling. Economically, markets only operate at price points where the product can be profitably offered and buyers are willing to pay the cost. Politically, governments have often been providers of risk transfer when their citizens face technical or economic limitations, but growing public expenditures to pay claims after natural disasters can create fiscal stress that leads to political pullback from such programs.

Probable Futures is made possible by generous donations.

Technical limits to insurability: when the math breaks

Historically, the main risk for policyholders in insurance markets was the solvency of insurers. An insurer who can’t pay policyholders after a loss not only harms the policyholder but decreases confidence in insurance as an industry. Insurers chose names and messages that signaled reliability to attract business, and regulators scrutinized insurers’ balance sheets. Over the past century, however, various forms of insurance became so common and reliably available that the focus of advertisers and consumers shifted from availability to affordability. Even U.S. state regulators made this shift: instituting increasingly restrictive limits on insurance companies’ ability to raise prices. Implicitly (and sometimes explicitly), homeowners, investors, lenders, and regulators assumed that physical risks were either completely stable or would only change very slowly. For buyers, insurance became simply another cost-of-ownership, similar to a phone bill or mortgage payment.

But insurance is not a simple product. It is a function of scale, probability, and correlation. And its pricing and availability can signal underlying risks.

Scale

With an insurance contract, a policyholder pays their insurer an annual premium in order to be compensated for certain types of losses if they occur. Those premium payments cover not only the expected value of future payouts but also costs that the insurer incurs in the process of doing business. Such costs include marketing, claims adjudication, agents, administration, and taxes. In order for an individual or business to be willing to pay the premiums that cover additional costs, the potential losses from a risk (and thus the benefits of being covered) need to be relatively large. As a result, it is uneconomical for asset owners to seek insurance for small potential losses.

At the other end of the spectrum, however, very large risks can overwhelm an insurance company. To be viable, an insurer must have access to enough capital to cover potential losses, so an insurer cannot offer coverage for potential losses that would bankrupt the entire pool: Without sufficient funds to cover losses, the insurer is insolvent and out of business.

Consider the Covid-19 pandemic and the resulting economic downturn from government-mandated business closures. While many firms would have loved to have business interruption insurance to cover their revenue losses, no private insurer could have paid claims to all of its clients simultaneously. The P&C industry in the United States estimated that just one month of business interruption losses from the pandemic was more than 10 times larger than the claims handled by the industry over an entire year, and that just two to three months of such losses exceeded the total industry surplus (the difference between assets and liabilities and net worth). Globally systemic risks are not insurable because they are too big. The prospect of numerous, very large natural disasters in the same year poses a similar problem.

Probability and correlation

Intuitively, it makes no sense to insure something that has a 100% probability—the premium from the customer would have to cover the entire cost of the loss (in addition to the insurer’s cost of doing business), so there would be no economic benefit to risk transfer. But the upper limit of insurability tends to be far below 100%. Even risks at an annual probability of 10% or 5% are often not cost-effective to insure—the insurer has to pay so frequently that the required premium is very high—and the most commonly insured risks have an annual probability closer to 1%. For risks that are more frequent, it is usually more economical for asset owners to invest in risk reduction measures that make the loss less likely to occur, either by reducing exposure to the risk (e.g., moving away from areas with high wildfire risk) or by reducing vulnerability (e.g., strengthening assets to withstand wildfire).

The economic pressure to limit insurance to low probability risks tends to be socially beneficial, as it pushes people to reduce risks in other ways. One example would be the risk of coastal tidal flooding as sea levels rise. NOAA estimates that since the year 2000, the southeast and Gulf coast regions have seen increases in tidal flooding of over 400% and 100% respectively. This flooding has become so frequent, it is now a risk that must be lowered rather than insured.

Insurance works best when there is agreement about the likelihood that an event occurs, but while probabilistic analysis is central to the insurance industry, it does not come naturally to most people. To most people, a hazard with a 1% probability and a hazard with a 3% probability may seem similarly unlikely to occur. But an insurer is rightly focused on the meaningful difference that the hazard with 3% probability is three times more likely to occur than the hazard with 1% probability. If insurers know that if the probability of a risk has increased by even a few percentage points, they will require a substantially higher premium to take on the same risk. Property owners are likely to find the increase in their insurance premium alarming based on their perceived (but incorrect) probabilistic analysis.

Even if a hazard has an estimated probability of 1% for a given property, however, it may not be insurable if the hazard is likely to strike many policyholders at the same time—the problem of correlation. This is why large-scale natural disasters have long been harder for the private insurance market: When many members of a community experience a natural disaster at the same time, losses are higher and the insurer must have sufficient access to capital to cover all those claims at once. One way they do this is through reinsurance, or insurance for the insurers, which allows insurers to put locally correlated risks in global pools. Just as a small increase in the probability has a big impact, a small increase in the correlation of risks in a pool can drastically change the economics of insurance. For example, if, instead of being randomly distributed across years, large tropical storms are likely to come in bunches, the benefits of pooling many risks diminish.

Economic limits to insurability: when policyholders can’t afford it

It may seem logical that the price of insurance would rise proportionately with risk, but the price to insure more frequent or severe risks is much higher than for smaller risks because they require even larger, less correlated pools. For example, insurance companies may be able to underwrite hurricane or wildfire insurance, but they will need both to hold more capital and to buy reinsurance (or transfer risk in other ways) to ensure they can pay all the claims when a disaster hits. But holding more capital and buying more reinsurance have associated costs that are passed on to the policyholder, making disaster insurance more expensive. Sometimes the higher costs hit the limit of what people are willing and able to pay. This is the economic limit to insurability.

For example, recent research has found that households are generally unwilling or unable to pay a risk-based premium for flood insurance. When policyholders cannot or will not buy a policy, there is no market clearing: There is no demand at the price at which insurance can be supplied. This is an economic barrier to insurability and one we are seeing around the country as climate impacts accelerate.

Growing risks and rising premiums will require asset owners to reassess their assumptions about the economics of insurance. For instance, insurance premiums have historically been not only stable but also substantially lower than loan payments on household mortgages. But as changing risk leads to escalating premium increases, some consumers, investors, and lenders are starting to seek more information about the future trajectory of risk and pricing, which is not provided by an annual insurance premium. Increasingly, risk-aware buyers are beginning to ask insurers for quotes for coverage over longer spans (three, five, or 10 years).

Political limits to insurability: how long will the public sector provide coverage?

When there are technical or economic limits to insurability, governments often step in to provide insurance. These programs take a wide variety of forms around the world. For example, in the U.S., when the terrorist attacks of 9/11 showed that economic losses from such events could be devastating and potentially widespread, the federal government created a program to backstop limited commercial insurance for terrorism-related losses. The U.S. federal government similarly created a flood insurance program almost 60 years ago when private insurers pulled out. And when there have been economic breakdowns in providing hurricane wind or wildfire coverage, states have created “markets of last resort” to offer coverage to their residents. As risks of weather-related extremes continue to grow, some neighborhoods and regions are seeing almost a complete pullback of the private market, making state programs the only option for residents who want to remain in those places.

The design of government-created insurance programs raises difficult political and ethical choices about who pays the costs of disasters and how to incentivize investments in risk reduction. These programs tend to write policies at below private market rates by using ex post financing mechanisms that push the costs of disaster payouts for the people whom the program has insured to other policyholders in the state who rarely understand that they are being obligated to pay for other people’s losses. In the U.S., these state-based markets of last resort are not actually backed by the state budget, but rather are intentionally designed to have the claims of large disasters paid by future policyholders and low-risk policyholders by issuing assessments on insurance firms and/or policyholders throughout the state (such has been done by Florida, Louisiana, and California). As risks grow and become more visible, this practice of shifting the cost of insuring high-risk properties onto people whose properties face lower risks is unlikely to remain politically or fiscally viable. While everyone wants a lower price for their own insurance, no one is particularly happy to pay for other people to get a lower price.

Climate change is shrinking the range of insurability

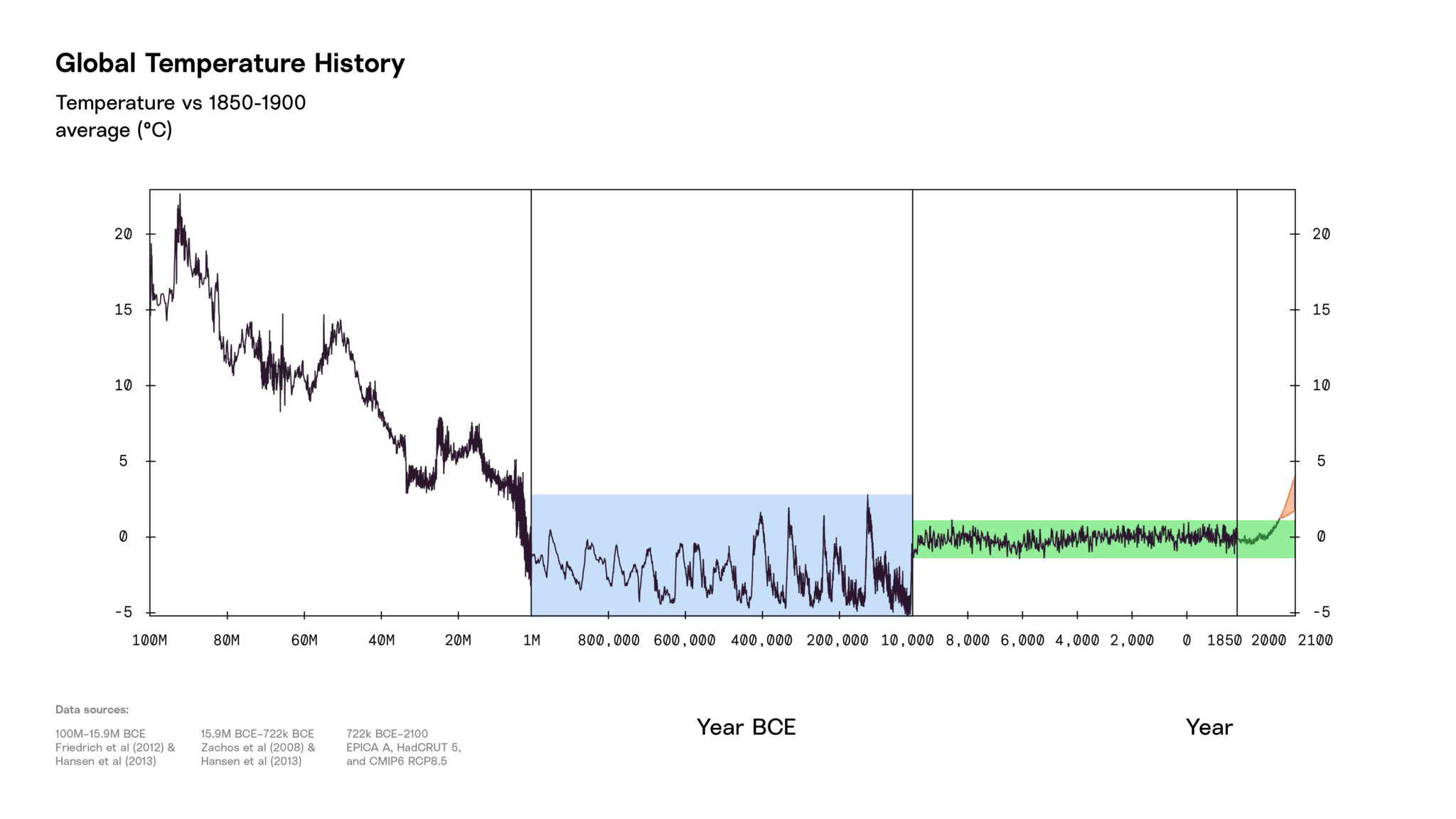

Because property insurance requires such mild, predictable circumstances, it’s remarkable that the industry has grown to be so large and critical to many societies. One of the main reasons for this success is that the earth’s climate was mild and predictable for so long. From 12,000 years ago up to about 2015, the average atmospheric temperature fluctuated just one degree Celsius above and below a stable average. This was the narrow range to which all living things, ecosystems, infrastructure, and property adapted. It is also the climate range for which we have backward-looking data and which scientists—from atmospheric scientists to catastrophe modelers—understand well.

Earth’s atmosphere was much warmer 20-100 million years ago and much less stable in the million years leading up to 9,500BCE (the blue band). From 9,500BCE to the early 21st century (the green band), the average atmospheric temperature fluctuated barely 1°C around a stable mean. As of 2025, the average atmospheric temperature is 1.5°C above the preindustrial average and projected to continue rising quickly.

Every place had a different climate than every other place, but the past weather patterns in a location—both the averages and the extremes—provided an accurate forecast of future weather patterns in that same place. If you had past data about rainfall, wind speeds, frequency and intensity of drought, and other hazards, you could accurately estimate risks. Similarly, the level of the oceans was stable and not rising. Property built a certain distance from the ocean was likely to stay that distance. All of this meant that both property owners and insurers had comparable expectations about risks.

Insurability is predicated upon risk being quantifiable: Until the 1990s, this was largely accomplished with actuarial approaches that relied heavily on historical losses. The advent of computer modeling and the huge increases in computing power led to the development of simulation-based models of large sets of potential hazard events. This improved risk quantification and supported greater insurability of some disaster risks by improving estimation of the most severe events. Still, the models were based heavily on extrapolation of past losses and past events.

But some perils that could have potentially been modeled with rigor and precision, including wildfire and severe convective storms, received far less attention from the modeling community than hurricanes and earthquakes because they historically caused few losses and were expected in a limited set of geographies. Accordingly, the insurance industry put fewer resources into modeling these perils.

As of 2025, the average global atmospheric temperature is 1.5°C above the pre-industrial average, outside the past range, and we will likely hit 2°C around 2040. As the atmosphere warms, historical data become an ever-worse guide to the future. Temperature is a measure of energy, Earth’s atmosphere and oceans have more energy in them than at any time since humans settled, and a system with more energy can produce more and more extreme outcomes.

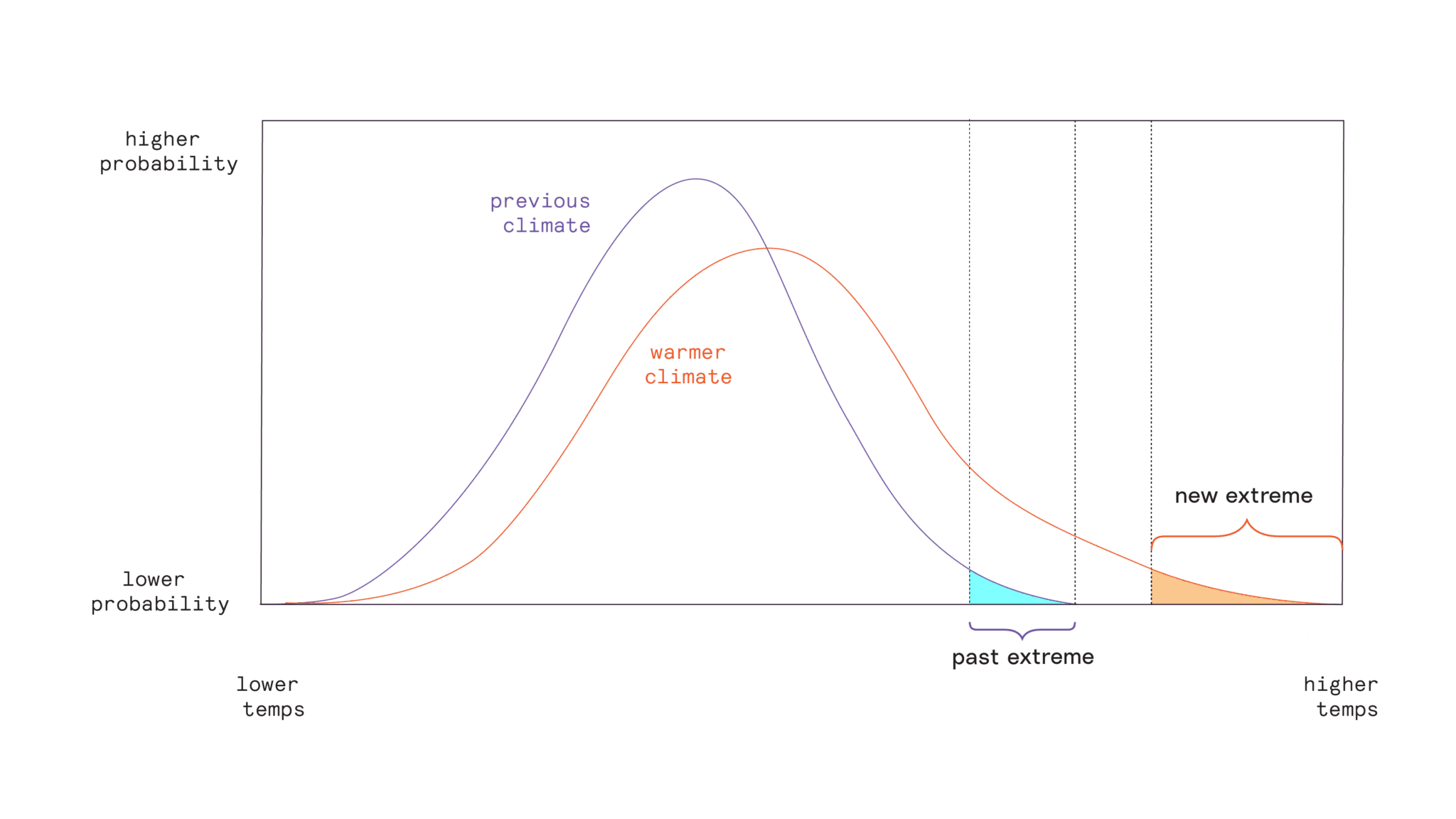

A warmer atmosphere shifts local climates

The distribution of temperatures in local climates spreads and skews as the average atmospheric temperature rises. “Normal” weather becomes less frequent, “past extreme” weather becomes common, and the new extreme tail of the distribution is both warmer and wider.

Greater energy in the system is now making the risks of many natural hazards less insurable by changing the frequency, severity, and correlation of many types of potential losses. “Record setting” is the new normal. Moreover, extremes that used to occur only in a limited set of locations are now likely in places where they have never occurred before. In 2023, a hurricane made its way to Southern California, and Louisiana struggled with wildfires.

As some risks become more likely, others become more severe, and new risks emerge. Together, these forces are shrinking the realm of insurability by fundamentally changing loss distributions. The “insurability window” is being compressed.

Fat-tailed loss distributions break the nice mathematical laws that underpin modern insurance; as the tails get fatter, insurance gets more expensive and harder to provide.

Take flooding and flood insurance. Some types of flooding, like coastal tidal flooding, are becoming too frequent to insure. At the same time, severe floods are getting worse. A look at flood insurance claims found that the tail may be getting fatter. Loss distributions with fat tails are problematic, as likelihood and severity don’t behave the way they used to. For example, if, in the past, the the 1-in-100-year storm in a given location (1% probability in a given year) would bring 6 inches (15 cm) and the 1-in-500-year storm (0.2% probability) would bring 9 inches (23 cm), a warmer atmosphere might make a 6-inch storm 5x more likely, a new 1% storm to drop 8 inches of rain, the 0.5% storm 10 inches, and the new 0.2% probability storm 12 inches: In other words, extremes are more likely than you might think, and the very extreme outcomes can be enormous. Fat-tailed loss distributions break the nice mathematical laws that underpin modern insurance; as the tails get fatter, insurance gets more expensive and harder to provide.

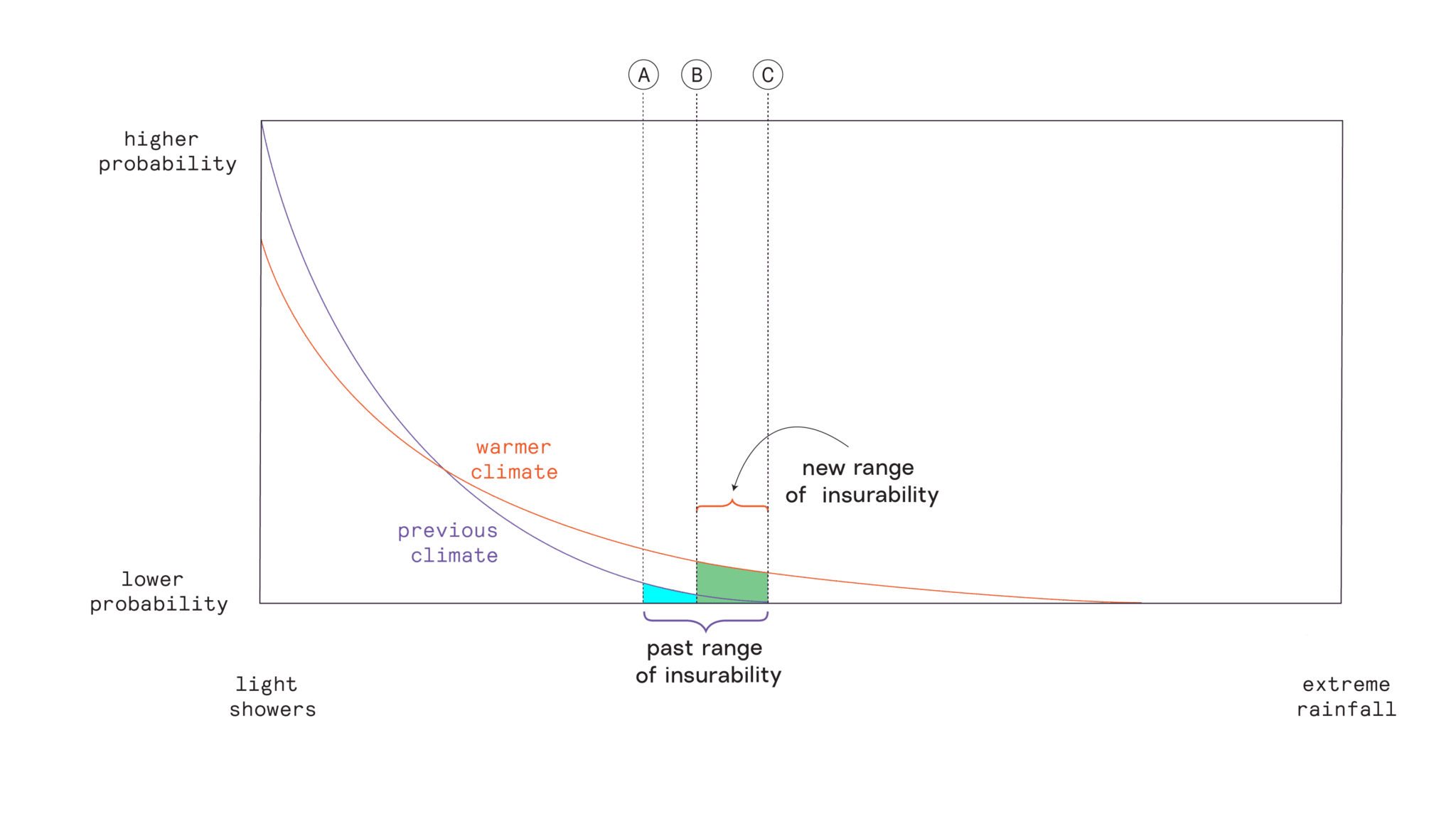

The range of insurability and extreme precipitation events

In a warmer climate, the probability of light showers tends to be lower, the probability of precipitation events that were considered extreme in the past is higher, and extreme events drop much more water.

In the past, precipitation events between A and C were insurable (the “window of insurability”). In a warmer climate, precipitation events between A and B are too frequent to insure, and the area beyond C is too extreme to insure. The new window of insurability between B and C covers a smaller range of perils, but because those events are much more likely, insurance will be more expensive.

With fatter tails, insurance firms must find profitable ways to build sufficient reserves or access enough capital for years with multiple large catastrophes. They expect premium payments to be insufficient in any given year to cover a large loss, but if catastrophes grow larger, more frequent, and more correlated, firms optimizing to keep the probability of insolvency below a certain level will be required to charge higher premiums (or stop offering coverage). These higher costs have to be borne by property owners and can stress willingness or ability to pay.

How to counteract the compression of the insurability range

Climate change presents new risks. Fortunately, climate science offers useful insight into the future so we can adapt, both in risk transfer and in society more generally.

Innovation in risk transfer

Insurance products and financial innovations can expand the realm of insurability. For example, parametric insurance policies rapidly pay a set amount based on observable measures of the disaster (often called the “trigger”). In theory, parametric insurance should feature lower transaction costs, since confirming whether a place or community has experienced rainfall, temperature, wind speed, or any other easily monitored phenomenon is far less costly and time-consuming than traditional loss adjusting and underwriting. Instead of having to send agents to assess damages after a disaster, payments can be made immediately after the set parameter has been met. Since parametric insurance is not tied to property losses, customers aren’t just property owners. Many early adopters of parametric insurance have been national governments knowing they will face increased demands after storms, droughts, and fires and benefit from the additional liquidity.

Innovation in business models and technology can also help make otherwise uninsurable risks insurable. For example, certain populations in developing countries have rarely met the requirements for affordable insurance because transaction costs were simply too high relative to expected losses. The advent and spread of mobile technology platforms have changed the economics of marketing, information sharing, payment, and tracking. Coupling those advances to parametric insurance has enabled small amounts of financial protection to vulnerable people around the world with quick payment post-disaster. There are now efforts to bring such products to the United States for hurricanes and earthquakes.

Financial innovations have also made it easier to insure large risks. Hurricane Andrew in 1992 and the Northridge earthquake in 1994, which shocked the insurance industry with the magnitude of their losses in Florida and California, respectively, led to innovations to expand insurability: the creation of the insurance-linked securities market (often referred to as “catastrophe bonds”) and more sophisticated models to assess risk.

“Catastrophe bonds” and related financial products provided innovative ways to transfer risk into global financial markets, beyond the insurance and reinsurance markets, as insurers recognized that disasters could be far costlier than previously anticipated, which sparked demand for risk capacity. Innovative investment firms, armed with a newfound ability to quantify these risks, found receptive demand among institutional investors who were seeking new assets that were not correlated with broader financial markets. Over the past 30 years, this market has grown steadily, as reinsurance and catastrophe bond returns have been uncorrelated with broader market risk. The 2024 market hit an all-time high issuance of $18 billion. That record was eclipsed in the first seven months of 2025. As of July 2025, there are over $50 billion of current insurance-linked securities outstanding. Increased attention on rising risks is likely to incentivize more people to look for innovative risk transfer solutions, but there will always be limits to risk capacity. Adaptation and risk reduction are the only large-scale, long-term solutions.

Climate adaptation and risk reduction

Reducing exposure and vulnerability to risks makes them easier and less expensive to insure. As the atmosphere warms further, a key strategy for property owners and entire communities to address climate-induced insurability challenges is to focus on climate adaptation and risk reduction.

We know how to build structures that can withstand hurricane winds and are much less likely to burn in a fire. We know how to build protective infrastructure for communities, such as wetlands to store floodwaters or levees to protect against rising rivers. We also know how to move individuals and families from risky to less risky locations. We also have accurate, informative tools to help individuals, organizations, and communities understand the risks they face now and are likely to face in the coming years. Unfortunately, there are many hurdles to scaling such investments or initiating big changes at the level of an entire community, state, or region.

While many “hardening” investments to make properties better able to withstand more severe conditions have been shown to be highly cost-effective, saving more over time than they cost, there are still up-front costs that must be paid, and financing models are not always readily available. Many investments are also essentially public goods and require public dollars; federal grants for risk reduction have been dramatically reduced by the current administration, and many states and local governments are stressed for funds. Preserving insurability will require communities to commit to safer building and land use patterns.

Where do we go from here?

We are not yet in imminent danger of widespread and systemic insurance market collapse, but pricing is higher and coverage is harder to access every year as risks continue to grow. The atmosphere is warming quickly, and with each fraction of a degree, these problems get more challenging. Now is the time to consider how we are managing increasing physical risks, since our decisions today about where and how we construct our buildings and infrastructure will determine our future resilience.

Our window of insurability is narrowing as the planet warms.

Our window of insurability is narrowing as the planet warms. To preserve the important financial protection that insurance provides to households, businesses, and the broader economy, we must refocus attention on the policies, innovations, and commitments to risk reduction that can preserve insurability. This will include reforms to our traditional insurance markets, as well as a wider range of risk transfer mechanisms, from informal risk sharing in defined communities to instruments that place risk into financial markets. It also means a commitment to transformative investments in climate adaptation.